Is $2 Million Enough To Retire At 60? [5 Case Studies]

- Mark Fonville, CFP®

- Mar 18, 2019

- 14 min read

Updated: Dec 17, 2025

Envision a retirement where the freedom to explore the country in a brand-new RV or traverse the globe is yours, unburdened by financial worries.

Sounds idyllic, doesn't it?

Yet, before you dive into these exciting plans, it's crucial to confront a pivotal question:

"Is $2 million enough to retire at 60?"

Even with exclusive access to the same cheat sheets we use to help our clients retire, making your $2 million last in retirement is hard.

This question is a common one among investors like yourself, who strive to sustain their hard-earned lifestyle into their golden years.

Let's face it, that shiny new RV or your dream European vacation isn't going to fund itself.

For many, a $2 million retirement fund is the epitome of a dream come true, promising a leisurely life post-retirement. However, for some, this figure may just mark the beginning of their financial planning journey.

So, what's the real deal here?

The answer hinges on your unique lifestyle and expenses. And let's not sugarcoat it – navigating retirement finances can be akin to running a challenging marathon, filled with its own set of hurdles.

Sure, $2 million might look like a towering sum, but remember, retirement is a long-term journey.

It's crucial to strategically plan and overcome financial obstacles to ensure your savings sustain you through the years of retirement.

A financial advisor can provide the clarity, insight, and confidence you need to help make your money last. If you want help putting all of the data in the article to work for your personal situation, consider requesting a free retirement plan from our team.

In this piece, we're breaking down whether $2 million is really enough based on how much money you need each month from your portfolio to supplement other sources of income like social security or a pension.

Here are the monthly supplemental income needs we analyze from each hypothetical case study:

Lower income need: $3,000 to $4,000

Middle income need: $5,000 to $6,000

Upper income need: $7,000+

We're bringing you the scoop from five different case studies, all updated for what's happening money-wise in 2025 and beyond.

Each one looks at a fictional couple with different lifestyle needs.

Today, things aren’t getting any easier for future retirees. From prices going up left and right (hello, inflation) to a super unpredictable bond and stock market, making sure your $2 million can keep you comfortable is getting tougher.

Lots of studies point out that a major worry for people nearing retirement or just starting it is the fear of running out of money way before they run out of retirement.

But here’s the kicker: Figuring out if $2 million is enough gets even trickier when you hit 60.

Why though?

Thanks to better healthcare, people are living longer (awesome, right?), which means you need your retirement savings to last maybe 30 years or even more.

Here's the catch: social security (the government's retirement help) might only cover about 20-40% of what you spend in retirement.

What's more, the smart money move for many retirees is waiting until you're 70 to start taking social security so you can get more bucks in the long run.

So, from age 60 to 70, you might need to rely on your saved $2 million way more, at least until that social security check starts coming in.

Here's a quick video that summarizes the results of our research.

Now, if you want to know the details behind the study, keep reading because it gets even more interesting from here.

In This Article, You Will Learn:

See How Our Financial Advisors Can Help You Retire With Confidence

Retirement Planning - Optimize your income and create a roadmap for a secure retirement.

Investment Management - Personalized investing to grow and protect your wealth.

Tax Planning - Identify tax strategies including Roth conversions, RMD management, charitable giving and more...

How to Stress Test a $2 Million Portfolio with Monte Carlo

When it comes to projecting income in retirement, the best financial advisors for retirement often use a retirement calculator called Monte Carlo Simulation.

If you're like many of our clients, the term "Monte Carlo" may take your mind to a seaside town in France as you enter one of the most famous casinos in the world.

Unfortunately, the Monte Carlo we are referencing isn’t as glamorous.

But it does a much better job at projecting the likelihood of being able to enjoy a comfortable retirement without running out of money.

If you would like a free monte carlo analysis, request a free retirement assessment with one of our experienced financial advisors.

At Covenant Wealth Advisors, we use Monte Carlo to help us estimate the probable outcomes of money lasting in retirement for clients.

Monte Carlo simulation works by running 1,000 possible stock market return scenarios by altering variables input into the tool.

The result is one number that represents the probability of making your money last in retirement.

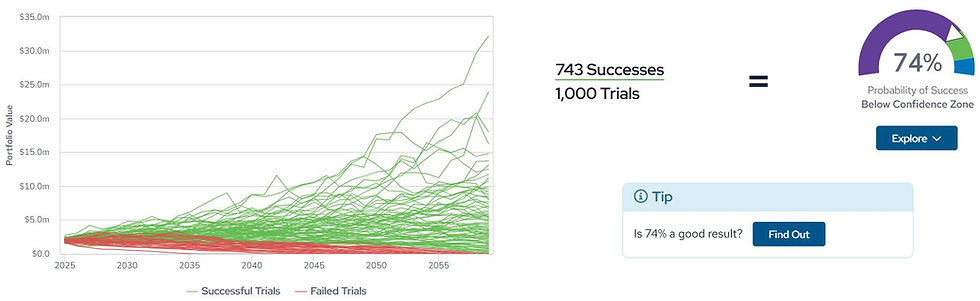

The chart below is an example of Monte Carlo results and provides a hypothetical example of 1,000 simulations.

Each green line indicates a single hypothetical simulation where a 60 year old couple accomplished all financial goals in retirement without running out of money.

Conversely, the red lines indicate scenarios where the 60 year old couple ran out of money.

Based on these results, Monte Carlo can help you answer a lot of questions including:

Do I have the right mix of investments?

Am I withdrawing too much from my portfolio?

Do I have enough money to live the lifestyle I want in retirement?

The tool can be used to determine the best course of action.

The example above reflects a Monte Carlo distribution for a 60-year old couple who wants to withdrawal $60,000 in year one inflating at 2.50% per year. They withdrawal the money from their $2 million portfolio over 35 years at an average rate of return of 5.32%. (Download Disclosures Here)

But, what if the couple wants to know what will happen if they increase their spending by $10,000 per year to $70,000?

Here are the results:

Notice that their probability of success drops to 74%. As you can see, you can answer a lot of questions with such a powerful tool.

Whether you have $2 million dollars, $3 million, $5 million (See our case study: Is $5 million enough to retire at 55) or more, Monte Carlo can be a great resource to help answer the toughest questions in retirement.

In the case studies below, we use a similar tool to stress test the likelihood of $2 million lasting in retirement for a 60 year old.

But, to determine if $2 million is enough to retire at age 60, you must include many factors such as:

Your monthly income need

Growth rate on your money and investments

Your life expectancy in retirement (maybe 30 years or more)

Federal and state tax rates

Additional considerations outside the scope of this article include: Social security benefits, healthcare expenses, additional spending needs such as vacation and cars.

Once you have accurate financial facts gathered, we can stress test the data thousands of times to determine your likelihood of success.

Technology has come a long way, right?

Your life, finances, and of course stock markets, are subject to change, and Monte Carlo Simulation helps paint a picture of possibilities—everything that could happen to prepare you for what could happen.

So, let's find out if $2 million is enough to retire at age 60.

I think you’ll be surprised by the results!

Case Study Results: Is $2 million enough to retire at 60?

Joe and Mary Schmoe celebrated their 35th wedding anniversary last weekend.

Their love carried them through a few moves, a few more careers, and two lovely children.

In 2025 they will each turn 60 years old. Dreams of retirement in a small town by the lake and making their $2 million last become their main focus.

It is time for them to enter a new chapter of their lives, together. Both in pristine health, they will need their money to last up to 35 years or until age 95!

I know what you’re thinking.

Planning to age 95 seems like a long time. Right?

As it turns out, a 60 year old non-smoking married couple in 2025 has a 40% chance of at least one individual living to age 95!

The chart below illustrates the probability of living to different ages for a 60 year old in 2025.

To help us find out if $2 million is enough to retire at age 60 for Mary and Joe, we analyzed five different case studies.

Each case uses the following assumptions:

35 years of portfolio withdrawals

Average tax rate after withdrawals begin is 20%

Income withdrawal increases every year at 2.50% to account for inflation

Average projected return is 6.05% per year

The only adjustment we made to each case study was the amount of annual withdrawal from the portfolio. This reflects differing income needs based upon lifestyle.

In the chart below, we summarize the monthly after-tax withdrawal amount from a $2 million portfolio and provide the probability of the money lasting 35 years in retirement.

As Mary and Joe's after-tax annual income need increases, the likelihood of their money lasting in retirement decreases!

Most investors would expect this.

But, what's most shocking is that three of the four case studies have a high probability of running out of money (less than 70% success rate).

Said another way, $2 million may be enough to retire for some, but it's certainly not enough to retire for others.

That's why it's so important for individuals nearing retirement to create a personal retirement income plan and not rely on generalizations.

So many factors can change the results including tax rates, timing of social security, Roth conversion, income need, and portfolio rate of return.

Everyone is different and the results for your situation could be far worse or better.

It all depends.

Those are the results at a high level. Now, let’s dive in a bit deeper by analyzing 5 scenarios with differing income needs starting at age 60.

Case Study 1: $2 Million Portfolio with $3,000 After-Tax Income Distribution

The first scenario provides Mary and Joe $3,000 per month of income from their $2 million portfolio. This is income they will need above and beyond any other sources such as social security or pensions. The money must last until they each reach age 95.

Here are some additional assumptions for case study 1:

Starting portfolio value: $2 million dollars

After-tax portfolio income per month: $3,000

Average tax rate: 20%

Retirement age: 60

Retirement start date: January 1, 2025

Retirement time horizon: 35 years

Portfolio mix: 60% stocks 40% bonds

Using Monte Carlo Simulation, the probability that their money will last 35 years is 96%.

With such a low withdrawal rate, their money has a very high probability of lasting throughout retirement as outlined in figure 1 below.

Figure 1

Case Study 2: $2 Million Portfolio with $4,000 After-Tax Income Distribution

In scenario two, Joe and Mary withdraw $4,000 per month from their $2 million portfolio. This is an increase of 33.33% from case study 1.

This is income they will need above and beyond any other sources such as social security or pensions. The money must last until they each reach age 95.

Here are some additional assumptions for case study 2:

Starting portfolio value: $2 million dollars

After-tax portfolio income per month: $4,000

Average tax rate: 20%

Retirement age: 60

Retirement start date: January 1, 2025

Retirement time horizon: 35 years

Portfolio mix: 60% stocks 40% bonds

Monte Carlo Simulation shows that the probability of the money lasting through retirement decreases to 87%.

This is not a low probability. But, probability of success decreased from scenario two due to the increase in retirement income drawdown.

Figure 2

Case Study 3: $2 million Portfolio with $5,000 After-Tax Income Distribution

In scenario three, Joe and Mary withdraw $5,000 per month from their $2 million portfolio. This is an income increase of 25% from case study 2.

This is income they will need above and beyond any other sources such as social security or pensions. The money must last until they each reach age 95.

Here are some additional assumptions for case study 3:

Portfolio value: $2 million dollars

After-tax portfolio income per month: $5,000

Average tax rate: 20%

Retirement age: 60

Retirement start date: January 1, 2025

Retirement time horizon: 35

Portfolio mix: 60% stocks 40% bonds

Case study 3 depicts a higher monthly income for Mary and Joe. By taking $5,000 after-tax each month, the likelihood of that money lasting 35 years continues to decline.

In this case, spending more money brings the probability of running out of money down to 69%! This is a huge drop from Scenario 2 which is 87%.

The 18% difference is nothing to scoff at and can have a huge impact on their ability to make their savings last.

Figure 3

Case Study 4: $2 Million Portfolio with $6,000 After-Tax Income Distribution

In scenario four, Joe and Mary withdraw $6,000 per month from their $2 million portfolio. This is a 20% increase in income need from case study 3.

This is income they will need above and beyond any other sources such as social security or pensions. The money must last until they each reach age 95.

Here are some additional assumptions for case study 4:

Starting portfolio value: $2 million dollars

After-tax portfolio income per month: $6,000

Retirement age: 60

Retirement start date: January 1, 2025

Retirement time horizon: 35

Portfolio mix: 60% stocks 40% bonds

If Mary and Joe withdraw $6,000 per month for 35 years, the probability of their money lasting through retirement decreases to 49%.

Case study 4 creates a real concern for Joe and Mary. Their higher lifestyle creates a need for greater income. As a result, their $2 million portfolio only funds their retirement income needs 49% of the time across 1,000 simulations.

Figure 4

Case Study 5: $2 Million Portfolio with $7,000 After-Tax Income Distribution

Our final case study illustrates the most aggressive income need for Joe and Mary which is $7,000 on an after-tax basis.

Unless a miracle happens, Joe and Mary will almost certainly run out of money if they retire at age 60 with $2 million and withdraw $7,000 after-tax per month form their portfolio.

This is a 233% increase from case study 1.

Here are some additional assumptions for case study 5:

Portfolio value: $2 million dollars

After-tax portfolio income per month: $7,000

Retirement age: 60

Retirement start date: January 1, 2025

Retirement time horizon: 35 years

Portfolio mix: 60% stocks 40% bonds

With an income need of $7,000 per month, the probability of $2 million lasting 35 years in retirement tumbles to 30%!

Figure 5

How to Make $2 Million Last in Retirement

You may be thinking, "wow, based on these assumptions, I'll be okay".

Here's the problem: "Is $2 million enough to retire at 60?" may actually be the wrong question to ask in the first place!

You should be asking, "How can I make $2 million last in retirement?" When you rephrase the question, you may put yourself in a better position for actually making it happen!

But, where do you start?

There are a lot more questions to consider when it comes to thinking about retirement. Finding the right answers may significantly improve your odds of success.

To help, you can access our library of powerful retirement checklists including:

The truth is, making your $2 million last from age 60 onward isn’t easy. But, it is possible and even highly probably if coordinated the right way.

See How Our Financial Advisors Can Help You Retire With Confidence

Retirement Planning - Optimize your income and create a roadmap for a secure retirement.

Investment Management - Personalized investing to grow and protect your wealth.

Tax Planning - Identify tax strategies including Roth conversions, RMD management, charitable giving and more...

Conclusion

In the case of Mary and Joe, the more money they withdraw from their portfolio per month, the less likely their $2 million will last throughout retirement.

While monte carlo is a great tool to help determine if your money will last, there are many factors that go into determining the amount of money you need to retire at age 55, 60, or 65.

Two million dollars might be enough for some people, but others may require $1 million, $3 million, $5 million, $10 million, or more.

It all depends on your lifestyle and the strategies you follow.

If you have $2 million and want to retire at age 60, it is important to start with your desired lifestyle and how much that lifestyle will cost you. This will help determine the amount of money you should have in your accounts.

But the amount of money you have is just one piece of the puzzle.

It is important to consider the age you want to retire, your life expectancy, and how your portfolio is invested. Additional variables such as your tolerance for investment risk, social security income, order in which you withdraw money from your accounts, pensions, and many other financial factors can impact whether or not $2 million will be enough to retire at 60.

One of the biggest factors that impacts your ability to make $2 million last in retirement is taxes. Proper tax planning is paramount and, if done correctly, can potentially save you hundreds of thousands of dollars in retirement.

The truth is that making your money last in retirement requires discipline, a well-structured portfolio, and tax-efficient retirement income strategies well beyond the scope of this article.

At Covenant Wealth Advisors, we can help you create an investment plan that creates a consistent stream of income for the rest of your life.

We are independent Certified Financial Planner™ practitioners who operate on a fee-only basis (learn about our services and fees here); meaning we never receive commissions for product sales. Additionally, we serve as a fiduciary which means we are required by law to always put your best interests and objectives at the forefront. We can help you find the right retirement strategies to conserve your wealth and the right investments to achieve your goals.

Need help making your money last in retirement?

Request a free retirement assessment. We can meet virtually with clients throughout the United States.

About the author:

CEO and Senior Financial Advisor

Mark is the CEO of Covenant Wealth Advisors and a Senior Financial Advisor helping individuals age 50+ plan, invest, and enjoy retirement comfortably. Forbes nominated Mark as a Best-In-State Wealth Advisor* and he has been featured in the New York Times, Barron's, Forbes, and Kiplinger Magazine.

Disclosures:

Covenant Wealth Advisors is a registered investment advisor with offices in Richmond and Williamsburg, VA. We provide investment management, financial planning, and tax planning services to individuals age 50 plus with over $1 million in investments. Investments involve risk and does with possible loss of principal and does not guarantee that investments will appreciate. Past performance is not indicative of future results.

The views and opinions expressed in this content are as of the date of the posting, are subject to change based on market and other conditions. This content contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Please note that nothing in this content should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account.

Nothing is intended to be, and you should not consider anything to be, investment, accounting, tax or legal advice. If you would like accounting, tax or legal advice, you should consult with your own accountants, or attorneys regarding your individual circumstances and needs. No advice may be rendered by Covenant Wealth Advisors unless a client service agreement is in place.

The RVA25 is an annual survey performed by Richmond BizSense. Companies profit and loss statements were reviewed by an independent accounting firm, Keiter CPA, and analyzed for three year revenue growth end December 31st, 2019. The top 25 fastest growing companies were chosen as recipients of making the RVA25 list. No fee or compensation was provided to Richmond BizSense or Keiter CPA for participation in the survey.

Forbes Best-In-State Wealth Advisor full ranking disclosure. Read more about Forbes ranking and methodology here.

Registration of an investment advisor does not imply a certain level of skill or training.